Together with our supporters and partners, Florida Community Loan Fund continues to drive positive economic and social change in Florida as we provide flexible capital that improves lives and communities and fosters success for our borrowing partners.

In this year’s Annual Report, we share inspiring stories from the communities that are strengthened by the work we are doing, and we invite you to dream of the future we can build together for Florida.

STRENGTHENING FLORIDA COMMUNITIES & BUILDING FUTURES

WITH AFFORDABLE HOUSING

Hope Partnership, Osceola County

FCLF IMPACT: $1 million FCLF financing, featuring a low interest rate made possible through the Capital Magnet Fund • $5 million total project budget • loan for acquisition and renovation of an outdated motel • 32 units of affordable rental housing + drop-in community service center

Seven on Seventh, Fort Lauderdale

FCLF IMPACT: $1 million FCLF financing, featuring a low interest rate made possible through the Capital Magnet Fund • $28.7 million total project budget • 72 units of affordable rental housing • provides housing in partnership wth homeless services agency located on adjacent property

Griffin Lofts, Lakeland

FCLF IMPACT: $7 million FCLF financing • $24 million total project budget • loan for new construction • 60 units of affordable and supportive rental housing

Catchlight Crossings, Orlando

FCLF IMPACT: $8.5 million FCLF financing, featuring a low interest rate made possible through the Capital Magnet Fund • $350 million total project budget • construction and infrastructure financing • 1,000 units of affordable rental housing + 72,000 sq feet of community space

STRENGTHENING FLORIDA COMMUNITIES & BUILDING FUTURES

WITH ESSENTIAL SERVICES

Metropolitan Ministries MiraclePlace Pasco

FCLF IMPACT: $13 million FCLF NMTC allocation + $3.7 million FCLF community development financing • $23.3 million total project budget • 43,800 sq feet of new construction or renovated space • estimated reach 20,100 annually with services and housing to families experiencing or at risk of homelessness • 119 jobs created or retained

Boys & Girls Clubs of Sarasota and DeSoto Counties

FCLF IMPACT: $7 million FCLF NMTC allocation • $10 million total project budget • 33,175 sq feet of new construction and renovated space • estimated reach 250 annually • 46 jobs created or retained

The Sharing Center, Sanford

FCLF IMPACT: $1.1 million FCLF financing • loan for rehabilitation of commercial-retail and nonprofit services space • 18,000 sq feet for services to low-income and homeless populations

STRENGTHENING FLORIDA COMMUNITIES & BUILDING FUTURES

WITH HURRICANE RECOVERY LOANS

When a hurricane strikes, many Florida Community Loan Fund borrowers face a double-edged crisis: their damaged facilities require immediate repair to restore services for low income populations relying on their assistance – many of whom need help now more than ever – yet tight operating budgets make funding repairs while awaiting insurance proceeds virtually impossible.

FCLF Hurricane Recovery Loan Impact

FCLF IMPACT: $2,775,500 FCLF financing for hurricane repairs or working capital • 27 hurricane recovery loans • Zero cost to borrowers

Cumulative through FY2024Community Assisted & Supported Living • providing housing and services for adults with disabilities in Southwest Florida • $650,000 financing (4 loans) through FCLF hurricane recovery loan program • roof replacement on 28 properties and additional roof repairs.

Bishop Museum of Science & Nature • museum in Southwest Florida focusing on youth education and outreach to low-income families • $150,000 financing through FCLF hurricane recovery loan program • repairs to multiple building roofs and gutters.

OUR IMPACT

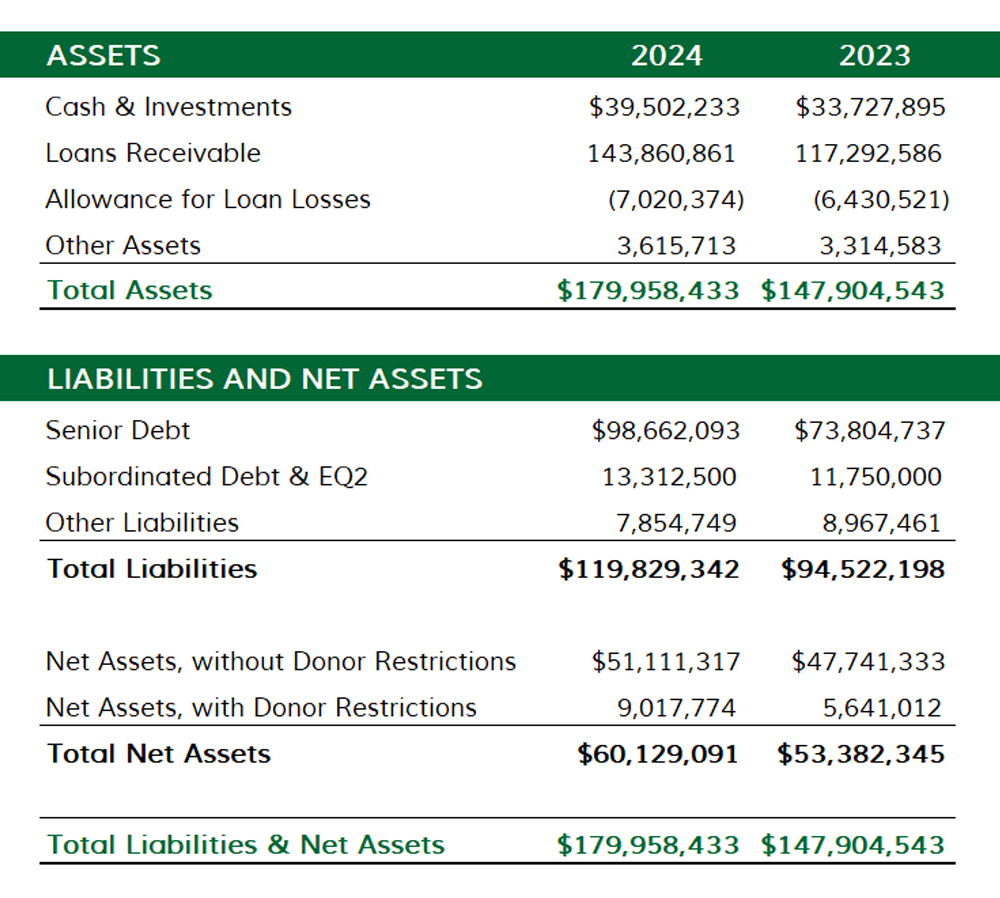

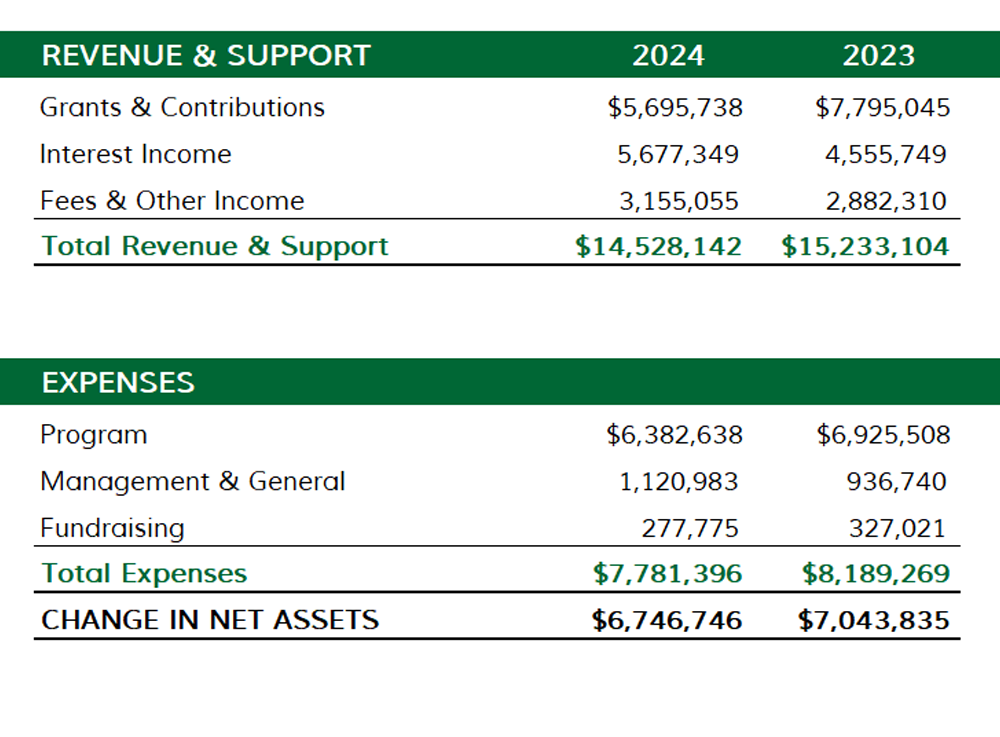

FINANCIAL RESULTS 2024

Summary Statement of Financial Position

Summary Statement of Activities

Loan Portfolio by Sector

INVESTORS AND SUPPORTERS

Religious Organizations • Adrian Dominicans • Archdiocese of Miami • Diocese of Palm Beach • Diocese of Venice • Mercy Partnership Foundation • Oblates of St. Francis de Sales • Religious Communities Impact Fund • Religious of the Sacred Heart of Mary, In Memory of Sr. Mary Heyser • School Sisters of Notre Dame (Maryland) • Sinsinawa Dominican Sisters • Sisters of Charity of Nazareth • Sisters of Charity of St. Elizabeth • Sisters of Providence • Sisters of St. Francis of Philadelphia • Sisters of the Blessed Sacrament • Sisters of the Holy Names of Jesus and Mary • Sisters of the Sacred Heart of Mary • Trinity Health • Union for Reform Judaism

Financial Institutions and Corporations • Amerant • Banesco USA • Bank of America • BankUnited • BMO Harris Bank • Comerica Bank • EverBank • FineMark National Bank & Trust • Fifth Third Bank • First Citizens Bank • First Horizon Bank • First Republic Bank• Florida Capital Bank • HSBC Bank USA, NA • Northern Trust • PNC Bank • Raymond James Bank • Regions Bank • Santander Bank • Seaside National Bank & Trust • SouthState Bank • Synovus Bank • TD Bank • Third Federal Savings & Loan • Truist Bank • Trustco Bank • United Community Bank • US Bancorp Community Development Corporation • US Bank, NA • Valley Bank • Wells Fargo Bank • Woodforest National Bank

Foundations • Bank of America Foundation • The Erich and Hannah Sachs Foundation • The Father's Table Foundation • Florida Blue Foundation • Health Foundation of South Florida • JPMorgan Chase Foundation • PNC Foundation • TD Charitable Foundation • Wells Fargo Foundation

Nonprofit Organizations • Good to Grow Fund • Opportunity Finance Network

Government Agencies • Community Development Financial Institution (CDFI) Fund of the U.S. Department of the Treasury

Individuals • G. Dawson • M. & V. Simmons

FCLF BOARD OF DIRECTORS

Tina Brown, Chair. CEO, OYC Miami

Germaine Smith-Baugh, Vice Chair. President & CEO, Urban League of Broward County

Alecia Dillon, Treasurer. CFO, Health Foundation of South Florida

Victor Rivera, Secretary. VP of Lending, Civic Builders

Claire Raley, Immediate Past Chair.

Lauren Butler, Impact Financing Intitiative Relationship Manager, Truist Bank

Ernest Coney, Jr., President & CEO, CDC of Tampa

Annie Neasman

David R. Punzak, Esquire

John Talmage, Director, Lee County Economic Development Office